Term Loans vs Revolving Credit Facilities

When running or growing a business, securing the right kind of finance can be critical. Two common options many UK businesses consider are term loans and revolving credit facilities (RCFs). Each has its place, advantages, trade-offs and costs. Knowing which is right for your needs can save you money, reduce risk, and help you plan more effectively.

Which Finance Option Suits Your Business Best?

A term loan is a lump sum of money borrowed from a lender, repaid over a set period (the term) with scheduled payments (often monthly), typically consisting of principal plus interest. Key features include:

- Fixed or variable interest rate.

- Fixed repayment schedule over a defined number of months or years.

- Often used for specific, one-off capital expenses (expansion, equipment, property, acquisitions).

- Once the loan amount is repaid in full, the facility ends (you can’t redraw unless you arrange another loan). (capitalise.com)

What Is a Revolving Credit Facility?

A Revolving Credit Facility (or line of credit) offers a flexible borrowing arrangement. Under this:

- The lender agrees to an upper credit limit. You can draw any amount up to that limit, repay, and draw again (so long as the facility period remains active).

- Interest is only charged on the amount you actually draw, not on the total credit limit. (capitalise.com)

- Typically used for working capital, seasonal cash flow gaps, unexpected costs or maintaining liquidity. (British Business Bank)

When One May Be Better Than the Other

Here are some scenarios when a term loan is likely the better choice, and others where an RCF may be preferable.

Use a Term Loan When:

- You have a single, substantial investment you want to finance (e.g. buying assets, machinery, property).

- You want fixed and predictable monthly costs to plan budgets.

- Interest rates are favourable, especially if you can lock in a low fixed rate.

- You do not expect large fluctuations in cash flow that would make rigid repayments difficult.

Use a Revolving Credit Facility When:

- You need flexibility – to cover fluctuating cash flows, seasonal peaks, or emergencies.

- You want access to funds “on demand” without applying each time.

- Your business has unpredictable costs or payments, and you need liquidity.

- You will not always use the full credit – so paying interest only on used amounts is more efficient.

Common Costs & Hidden Charges to Be Aware Of

Whether you choose a term loan or an RCF, there are costs beyond just the headline interest rate. Some things to watch for:

- Arrangement / Setup Fees – always ask what the one-off fees are.

- Commitment / Undrawn Fees – for RCFs, for the portion of the facility you haven’t used, lenders may charge a fee simply for reserving it.

- Renewal / Annual Review Fees – some facilities are reviewed yearly or at set intervals; terms may change. (Funding Bay)

- Penalty / Early Repayment Charges – often with term loans if you want to repay earlier than scheduled.

- Interest Type – fixed vs floating; floating rates can shift with base rate / Bank of England rate changes.

- Security / Guarantees – some loans or credit facilities may require collateral or personal guarantees.

Regulatory, Financial & Risk Considerations in the UK

When arranging either finance option in the UK, you should keep in mind:

- Creditworthiness: Lenders will look at your accounts, cash flows, past performance. For RCFs, sometimes more frequent monitoring is required.

- Impact on Credit Rating: Use of and repayment behaviour affect credit scores. Over-borrowing or failing to repay can harm future access to finance.

- Legal documentation: Both term loan agreements and revolving facility agreements must clearly set out repayment, fees, interest, covenants, etc. (London Registrars)

- Governance: There may be covenants which restrict what you do (e.g. on other borrowing, minimum cash balances).

- Economic & Interest Rate Risk: Floating rates exposure, inflation effects, and economic downturns can make flexible debt more expensive or harder to service.

Insights from Alternative Bridging (and other sources)

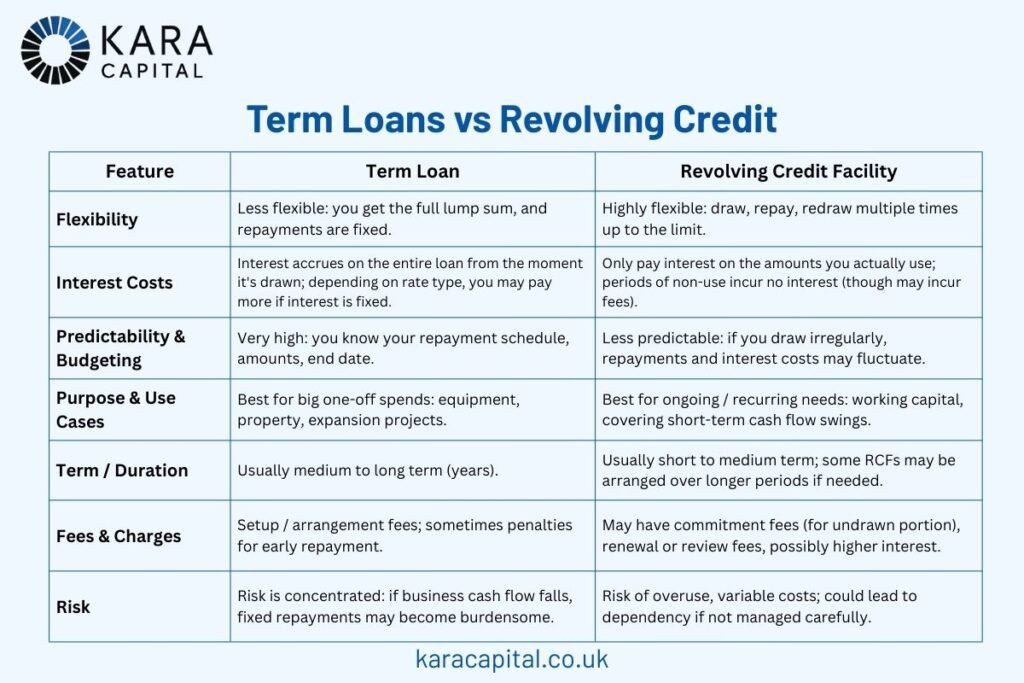

The article “Term Loans vs Revolving Credit Facilities” from Alternative Bridging provides a clear side-by-side breakdown of the features and trade-offs. It emphasises that:

- Term loans give certainty (fixed payments, known duration), which helps in planning long-term investments.

- Revolving credit is more suited to ongoing or irregular needs – keeping liquidity on hand, smoothing over cash gaps.

- The cost structure (interest + fees) of RCFs can be higher, especially if you often draw near the credit limit or leave funds undrawn but committed. (Funding Bay)

How Karacapital.co.uk Can Help

At Karacapital.co.uk, we specialise in helping businesses and individuals understand and access finance in ways that best fit their needs. Here’s how we help when deciding between term loans and revolving credit facilities:

- Assessment of Needs & Cash Flow Forecasting

We help you map out your upcoming expenses, income, seasonal variation, and investment plans to see which finance type aligns best. - Comparative Cost Analysis

We calculate total cost over the life of finance options (interest, fees, likely usage) so you can see which one gives better value under realistic scenarios. - Tailored Advice

Every business is different: where growth, risk tolerance, or upcoming projects differ, so will the recommended financing structure. - Access to Lenders

We work with a network of lenders, including ones specialising in term loans, and others offering flexible revolving facilities. That means better options, competitive rates, and more suitable terms. - Support Through Application & Documentation

We assist with preparing business plans, financial statements, compliance and legal documentation to ensure your application has the best chance of approval, whether for a fixed-term loan or a revolving facility.

Case Examples

Here are hypothetical scenarios showing what might work best in practice:

- Example A – Manufacturing Business with Seasonal Demand

A business that sells more heavily in summer may need extra stock in spring, then lower in winter. A revolving credit facility could allow flexibility to draw funds when needed, then repay when sales come in. - Example B – Company Buying New Machinery

A firm wants to invest in new production machinery costing £200,000. Because this is a one-off capital expenditure with clear repayment capability, a term loan with fixed repayments over 5 years may be more appropriate. - Example C – Business Facing Unpredictable Costs

Suppose a business has irregular contracts, sometimes delayed payments, and occasional unexpected expenses (repairs, legal, etc.). An RCF may provide a safety net to handle those irregularities without putting everything on a fixed schedule loan that might strain cash flow during lean months.

Which Should You Choose? Key Questions to Ask

To decide which is right for you or your business, consider these questions:

- What is the purpose of the finance? Expansion? Equipment purchase? Covering operational cash flow?

- What is your cash flow like? Do you expect reliable, steady income, or is your cash flow variable?

- How much flexibility do you need? Are you okay with fixed repayments, or do you need the ability to draw / repay irregularly?

- What is your risk tolerance? Floating vs fixed interest rates, uncertain income, or potential changes in business conditions.

- What costs are involved? Interest, fees, commitments, penalties.

- What kind of lender / documentation will be needed? Do you have the required financial records, business plan, guarantor or security?

Potential Downsides & Risks of Mis-Choosing

Choosing the “wrong” type of finance can lead to issues:

- Taking a term loan when you need flexibility may leave you paying interest on unused funds, or struggling with repayments in bad months.

- Using an RCF frequently may lead to very high interest and fees, spiralling debt if cash flow drops.

- Overreliance on credit facilities may also harm your credit rating or put you in debt cycles.

- If you don’t read the fine print, you may face hidden fees, restrictive covenants, or penalties.

Summary & Recommendations

- Term loans are best for one-off investments, when you can forecast income well, and you want certainty in repayment.

- Revolving credit facilities are best for ongoing, irregular, or emergency funding needs, giving flexibility to access funds on demand.

- The “true cost” of each option depends not only on interest, but on fees, the way you will use the credit, how regular your cash flows are, and how comfortable you are with variable vs fixed terms.

- Using a finance broker or adviser (such as Karacapital.co.uk) can help ensure you choose the right product and avoid costly mistakes.

Conclusion

In the world of business finance, there’s rarely a one-size-fits-all solution. Term loans and revolving credit facilities each have their strengths and drawbacks. The best choice depends on your specific situation: how predictable your revenue is, how big the investment is, how much flexibility you need, and how much risk you can tolerate.

By carefully analysing your needs, comparing total costs, and aligning your finance choice with your business plans, you’ll be in a stronger position. And with expert partners like Karacapital, you can navigate this complexity with confidence.