How Much Will a Bridging Loan Cost?

When you’re exploring short-term property finance, one of the first questions you’ll ask is: how much will a bridging loan cost me? The answer depends on interest rates, fees, property type, and the lender you choose. In this blog, we’ll break down the typical costs of bridging finance in the UK, using estimates from respected industry sources, alongside insights from Kara Capital.

What Is a Bridging Loan?

A bridging loan is short-term finance designed to “bridge” a funding gap. Homeowners often use it to purchase a property before their current one sells, while developers use it to fund renovations or land purchases.

According to Bridging Loan Directory, these loans are typically available for terms between a few weeks and 24 months, and are secured against property or land.

Kara Capital provides specialist bridging and development finance across the UK, focusing on quick decision-making and competitive rates (Kara Capital).

Interest Rates – The Main Cost

The monthly interest rate is the largest ongoing cost of a bridging loan.

- Residential bridging loans usually range between 0.5% and 1.5% per month (equivalent to about 6%–18% per year), according to Bridging Loan Directory.

- Commercial or riskier developments are higher, often 0.75% to 2% per month, as reported by BridgingLoan.org.uk.

- Finance Nation also confirms that UK bridging loan rates generally fall between 0.4% and 2% per month, depending on loan-to-value and borrower profile.

Example: If you borrow £200,000 at 0.79% monthly interest, that’s around £1,612 per month in interest payments (source: Online Mortgage Advisor).

Other Fees to Expect

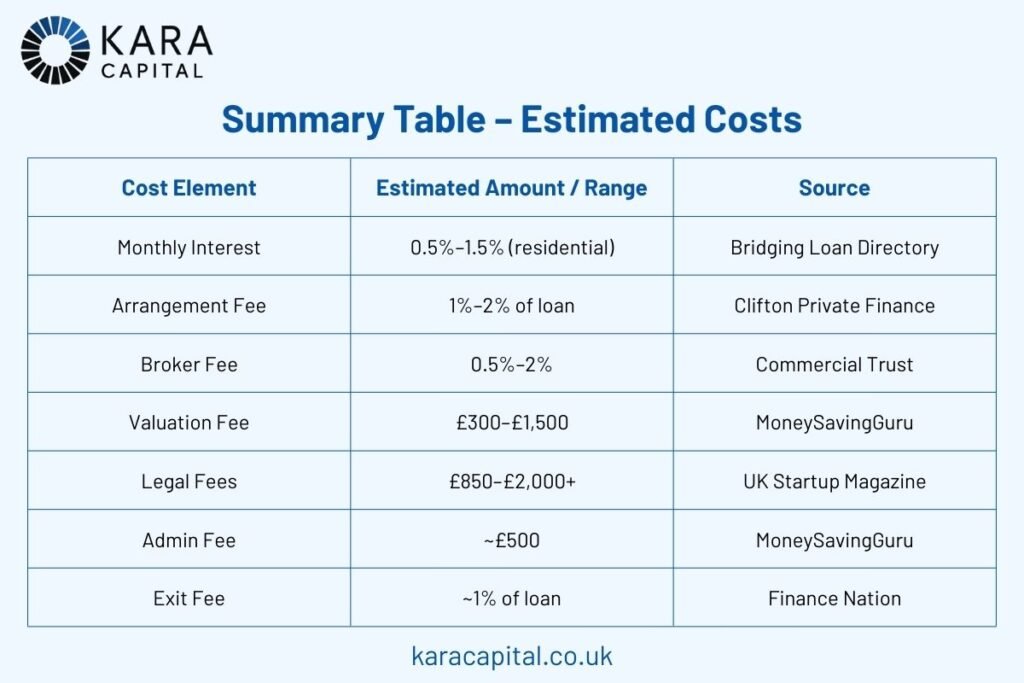

In addition to interest, borrowers must budget for various fees. Different lenders apply slightly different charges, but industry benchmarks are widely available:

- Arrangement (facility) fee: Usually 1%–2% of the loan (source: Clifton Private Finance)

- Broker fee: Around 0.5%–2%, or a flat charge depending on the deal (source: Commercial Trust)

- Valuation fee: Typically £300–£1,500, depending on the property’s value (source: MoneySavingGuru)

- Legal fees: From £850 up to £2,000+ (source: UK Startup Magazine)

- Admin or drawdown fee: About £500 (source: MoneySavingGuru)

- Exit/redemption fee: Often 1% of the loan or a fixed £100–£150 (source: Finance Nation)

Example Calculation – £300,000 Bridging Loan

Let’s estimate the cost of a 12-month residential bridging loan for £300,000:

- Interest (0.5%–0.6% monthly): £18,000–£21,600 total

- Arrangement fee (1.5%): £4,500

- Broker fee (1%): £3,000

- Valuation: £600

- Legal fees: £1,500

- Admin fee: £500

- Exit fee (1%): £3,000

Estimated total cost: £30,000–£34,000

(Source references: Expert Mortgage Brokers, BridgingLoan.org.uk, Commercial Trust)

What Affects the Final Cost?

According to Bridging Loan Directory and Expert Mortgage Brokers, these are the key factors:

- Loan-to-Value (LTV): Lower LTV = cheaper interest.

- Property type & condition: Standard residential is cheaper than commercial or development.

- Exit strategy: A clear repayment plan (sale or refinance) lowers the risk and cost.

- Loan term: Shorter terms often have lower interest.

- Borrower profile: Strong credit history helps secure better deals.

Why Kara Capital?

While the UK bridging loan market is crowded, Kara Capital distinguishes itself with:

- Flexible bridging and development finance across residential, commercial, and holiday-let markets

- Competitive rates tailored to each borrower

- Fast approvals and a straightforward process

For exact pricing, it’s best to request a personalised quote from Kara Capital directly.

Summary Table – Estimated Costs

Final Thoughts

Bridging loans are fast and flexible, but they carry higher costs than standard mortgages. Borrowers should look beyond the interest rate and budget for arrangement, legal, valuation, and exit fees.

By comparing multiple lenders and working with specialists such as Kara Capital, you can secure a deal that balances speed and cost.