Indicative Terms – What Are They?

When looking to borrow money, whether for property investment, development finance, or short-term bridging, borrowers will often encounter the phrase “indicative terms.” But what does this actually mean, and why does it matter when dealing with lenders such as those in the specialist property finance market?

This article explores the meaning of indicative terms, why they are important, and how firms like Kara Capital may apply them when working with property developers and investors.

What Are Indicative Terms?

Indicative terms (sometimes called indicative offers, term sheets, or agreements in principle) are non-binding proposals that lenders issue to potential borrowers at the early stage of a finance application.

They provide an outline of what a loan could look like before any legally binding contract is signed. The terms are designed to give borrowers a clear picture of:

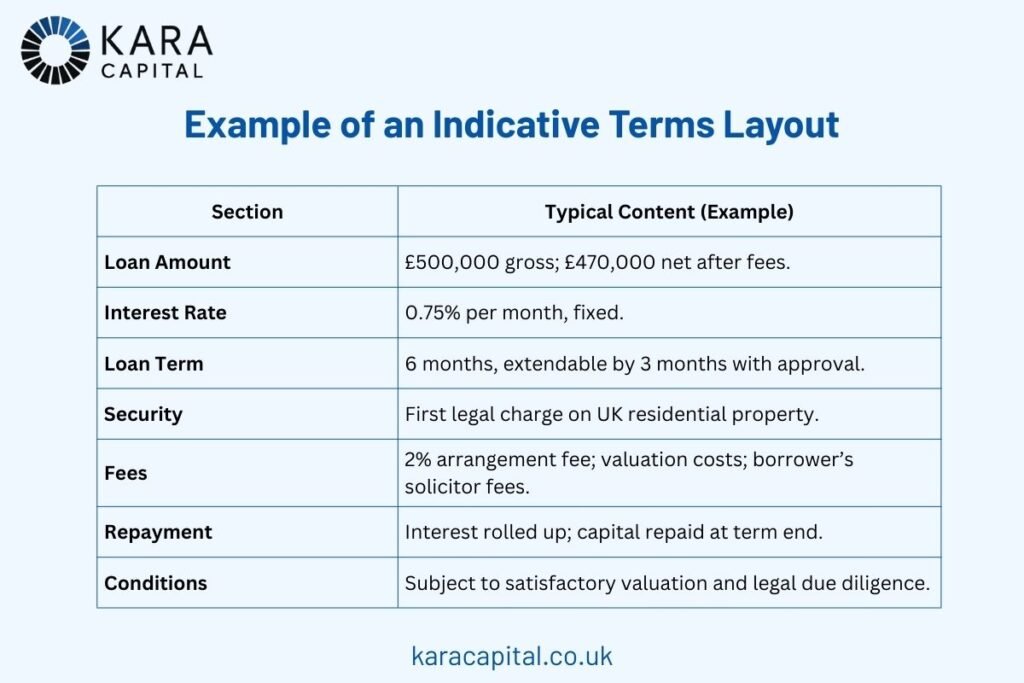

- The loan amount being considered.

- The proposed interest rate (monthly or annual).

- The intended loan structure and repayment plan.

- Associated fees and charges (such as arrangement fees or valuation costs).

- The loan term (for example, 6 months or 12 months).

- Security requirements, usually a legal charge over a property or asset.

Why Do Lenders Provide Indicative Terms?

Indicative terms are valuable for both lenders and borrowers.

- Clarity and Transparency

Borrowers can understand the headline features of the loan early on, without committing to legal costs or valuations. - Comparison Tool

When borrowers are approaching multiple lenders, indicative terms allow a straightforward comparison of interest rates, loan-to-value ratios, and costs (Alternative Bridging). - Feasibility Assessment

For property developers, indicative terms help decide whether a project is financially viable before investing further. - Negotiation Starting Point

They act as a foundation for discussions. Borrowers may negotiate on interest, fees, or repayment flexibility once they understand the proposed structure. - Due Diligence Insight

According to Roma Finance, borrowers should check how much due diligence a lender has completed before issuing indicative terms. If the terms are vague, it may suggest more uncertainty later (Roma Finance – Medium Article).

What Should Be Included in Indicative Terms?

Indicative terms vary from lender to lender, but according to finance experts such as Roma Finance and Alternative Bridging, a good document should answer questions like:

- What is the gross loan amount vs the net amount after fees?

- Is the offer subject to a valuation or further legal review?

- What interest rate is proposed, and can it change?

- How will interest be calculated (daily, monthly, retained, or rolled-up)?

- What security or collateral is required?

- What is the loan term, and can it be extended?

- What legal costs, arrangement fees, or exit fees apply?

- How long are the terms valid before they expire?

For borrowers, clarity on these points reduces surprises later and prevents disputes once the deal progresses.

Risks and Limitations

It’s important to remember:

- Indicative terms are not binding. Lenders can revise them after valuation or underwriting.

- Fees and interest may increase if risk assessments change.

- Some lenders may issue terms without much due diligence, making the offer look attractive initially but less reliable later (Roma Finance).

- Borrowers should always read carefully and ask questions before proceeding.

How Kara Capital Fits Into the Picture

Although Kara Capital does not explicitly use the phrase “indicative terms” on its website, its business model makes such terms a natural part of its lending process.

Kara Capital specialises in short-term bridging loans for property developers and investors, with loans secured by a first legal charge. The firm emphasises:

- Fast decisions and rapid funding – a common requirement in the bridging market.

- Transparent, asset-backed lending, giving borrowers confidence in the security structure.

- Tailored solutions that align with project needs, such as auction purchases, refurbishments, or development exits.

Given this approach, Kara Capital likely provides borrowers with indicative offers covering loan size, interest rate expectations, fees, security, and validity periods, allowing deals to move quickly from discussion to funding.

Example of an Indicative Terms Layout

Final Thoughts

Indicative terms are a vital stage in the borrowing journey. They give borrowers a transparent, non-binding snapshot of a lender’s offer and allow developers and investors to make informed decisions.

For firms like Kara Capital, where timing and clarity are crucial in the bridging loan market, well-structured indicative terms provide clients with confidence and enable projects to move forward efficiently.

Borrowers should always review indicative terms carefully, compare across multiple lenders, and, if necessary, seek independent financial advice before committing to any loan.